The future of logistics: how global supply chains are transforming

Growth and innovation while enduring the consequences of a perfect storm. The logistics, transport and supply chain sector now stands at a crossroads, caught between the tensions of a highly demanding present and the technological transformation that promises a very promising future.

.webp)

Table of contents:

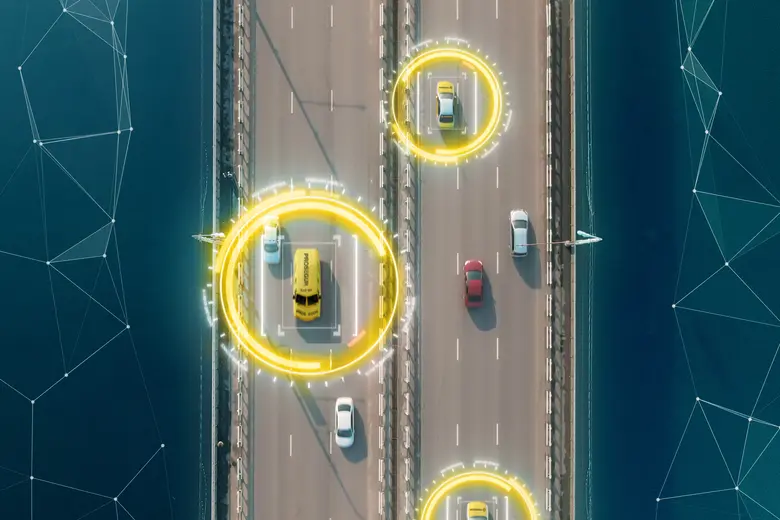

As a strategy for the future, Atanet considers it highly advisable to "accelerate the digitalisation process of these logistics networks". Applications of technologies such as digital twins already offer the option to "provide greater transparency and information to potential consumers and better manage physical and digital points of sale".

Improved data processing and analysis capabilities "will increase companies' ability to react by allowing them to better understand the situations that are occurring at any given time or even to anticipate potential problems". It is also advisable to "bring sales outlets as close as possible to the consumer, diversifying warehouses to create a distribution network that is as capillary as possible, thus reducing delivery times".

According to a survey by the forward-looking ToolsGroup, a high percentage of US companies are poised to make ambitious technology investments in the very near term, particularly to enhance their data and inventory management model. Atanet believes that these data will soon be extrapolated to Spain: “In this complex, competitive and globalised environment, large companies will seek qualitative advantages in Big Data, artificial intelligence, the internet of things, digital twins and the most advanced management software”. The logistics of the future will be technological or it won't be.

Atanet believes that "despite the significant progress made in the digital transformation process of the logistics sector", it was inevitable that all these problems "would end up affecting the end consumer". Frequent delays and in-stock availability issues for purchased products are "a frequent source of complaint among users". They are difficult to counteract in a scenario like the current one, but the effect of loss of confidence in the brand and in the service they offer can be alleviated, in Atanet's opinion, "by managing shipments and deadlines as transparently as possible".

Technological advances mean that many transport and supply companies have traceability and digital inventory management resources that were unthinkable until very recently. “This real-time information must be shared transparently with users", explains Atanet, "and it is also important that a realistic forecast of product availability and replenishment expectations is made".

Data managed by Prosegur's Market Intelligence department indicates that speed of delivery is one of the basic priorities for customers. Thirty-eight percent of Spanish digital shoppers with home delivery would be willing to pay more for the product to arrive sooner. However, with the exception of the under 25s, the group for whom immediacy of delivery is most important, a high percentage consider a waiting time of up to three days to be "acceptable".

"The channel bottleneck is a symptom of "how demanding and complex the global supply chain is right now".

%20int%20(1).webp)

As Atanet's team has found, "the supply chain has proven to be one of the most sensitive links in production and trade over the past few years". The Globalisation 2.0 process affecting world trade has created "a very high degree of interdependence of global supply chains, so that any local, regional or global event can translate into specific problems in any type of business".

In the wake of the closure of Chinese ports in the first half of 2020 and the Canal blockade in the spring of 2021, we are now facing "further confinements resulting from COVID in Shanghai, one of the main hubs of world trade" and other disruptive events, "such as local strikes or the shortage of certain products and components". Particularly significant in this last point is the semiconductor crisis, which has even paralysed the activity of automotive giants such as Hyundai, Ford and General Motors and is still dragging on. The persistence of many of these factors leads Atanet to conclude that "the remainder of 2022 will continue to be a period of deep stress on logistics for all companies".

A further significant indicator is that the cost of ocean freight continues to rise. Already in 2020, fares on some Asian routes increased tenfold. The International Monetary Fund calculates an average 40% increase in these costs since the beginning of the war in Ukraine, a very considerable impact considering that 80% of freight transport is by sea.

Perhaps one of the events that best illustrates the so-called butterfly effect, the disturbing notion that, in an interconnected world, the movement of a lepidopterist's wings in Shanghai can produce a tornado in Kansas, occurred on 23 March 2021.

On this spring day, the Ever Given, a Taiwanese-chartered cargo ship sailing under the Panamanian flag, ran aground on a bank of the Suez Canal, blocking traffic in both directions and causing a monumental traffic jam. Over 200 ships carrying thousands of tonnes of goods, trapped in a narrow sea corridor that is one of the main arteries of world trade.

A fleet of tugboats and a fortunate change in the tides six days later managed to successfully get the ship afloat again. This was already an economic disaster, with 12% of world trade temporarily paralysed, losses of up to 8 billion a day and even a 6% rise in oil prices.

Technology as a sure-fire recipe

The never-ending crisis

For David Atanet, Market Intelligence Manager at Prosegur, the channel bottleneck is a symptom of "how demanding and complex the global supply chain is right now". If the jamming of a container ship from Malaysia to Rotterdam in an Egyptian port can collapse world trade for a week, "we clearly face herculean challenges".

Atanet's job essentially entails identifying global background trends in the market segments related to Prosegur's activities. Logistics is among them and perhaps one of the most interesting and turbulent.

.webp)

When in doubt, transparency

The Globalisation 2.0 process affecting world trade has created "a very high degree of interdependence of global supply chains, so that any local, regional or global event can translate into specific problems in any type of business".

A decisive decade for supply chains

As a recent PwC study pointed out, transport and logistics have already entered "a disruptive decade" that is completely transforming their business model. Digitalisation and process automation will have reduced overall transport costs by 47% by 2030. Delivery times for products will decrease by 40% and automated last mile deliveries (i.e. the last proximity journey that products will make before reaching their destination) will cost 51% less than they do now.

This logistics optimisation process is already underway. It started at the end of the last decade and accelerated substantially with the rise of e-commerce and the widespread change in consumer habits and expectations brought about by the pandemic.

What is most striking, in David Atanet's view, is that such a qualitative leap is taking place in a context that he describes as "a perfect storm, with the brutal impact of the pandemic and associated confinements and restrictions, runaway inflation, geopolitical tensions such as the Russia-Ukraine war, and more sector-specific, but related, problems such as supply chain disruptions and supply crises". The logistics world has had to cope with "a high degree of volatility, with sudden increases in demand and stock-outs". And it has done so by exhibiting remarkable resilience and capacity to adapt to change.

.webp)

.webp)