Prosegur Corban: innovation and efficiency at the service of banks and customers

Prosegur Corban's extensive experience in Latin America makes it the ideal intermediary between the bank and its clients. The first facilitates efficient and close customer service, saves costs and administration and guarantees effectiveness, a better customer experience, physical support for digitisation and full transparency; the second provides the customer with speed, proximity and access to an unlimited catalogue of services. The model is also fully exportable to the Spanish market.

Imagine an intermediary between a bank and its customer; a professional, solvent intermediary, with proven experience and a vocation for innovation; who offers the bank an end-to-end service, saves it from dealing with dozens of suppliers and avoids headaches. It also makes life easier for the customer and substantially improves the user experience.

You can stop imagining. This intermediary is called Prosegur Corban, a business branch of Prosegur Cash which, for the time being, operates in five South American countries (Uruguay, Ecuador, Colombia, Brazil and Peru), providing advanced solutions to more than 300 financial institutions in these countries through three different services: robust correspondent banking, retail correspondent banking and servicing of digital accounts and funding (linked to wallets) for third parties.

Francisco Javier Sieyro is the global director of Prosegur Corban and, for him, the success and the high degree of implementation of this branch of business in South America is to be found in the increasing generalisation of the figure of the banking correspondent in these countries, but also in some characteristics of the particular financial ecosystem of this geographical area: high proportion of unbanked population, predominant use of non-direct debit payments (both cash and digital), banking implementation through mixed models of both network and technological and operational support, outsourcing and diversification of the catalogue of customer services, massive one hundred percent digital banking, need for servicing new digital banking players and achieving greater capillarity of the banking network...

In addition to the intrinsically financial characteristics, Sieyro adds the significant previous presence that Prosegur Cash already had in South America and ‘the enormous importance that these countries have for the company, both in professional terms and in terms of personal proximity’.

Two correspondent models

Robust correspondent banking is, in essence, an office that Prosegur Corban sets up and manages on behalf of a financial institution. But it also manages it in its entirety: from its location, the necessary equipment and infrastructure or the recruitment and training of staff, to the day-to-day operations, ‘which guarantee the customer entity an E2E model of office management to offer transactional, non-transactional and business services, which we call’, says Sieyro.

Identification with the parent bank is therefore full, and this is where, according to the head of this business line, the main difference between a robust Corban correspondent and other traditional correspondent banking services lies. ‘We are another arm of the bank, one of its main service channels—and increasingly one of its distribution channels—to provide its customers with a full range of products (accounts, cards, loans, insurance, etc.), with a focus on efficiency and service optimisation.

From his extensive experience, the director of Prosegur Corban assures that robust correspondent banking not only reduces management and installation costs for the financial institution, but also ‘improves the capillarity of services, allowing banks to focus on more complex and higher value-added products’. According to Sieyro, data from the more than 1,200 active points that Corban currently has in Latin America (and more than 300 in implementation) support high standards of excellence in service and customer experience.

Prosegur Corban's retail correspondent goes even further: It is not only designed for large financial institutions, but also for companies, suppliers, small businesses and even public administration. The first and most obvious advantage for all of them is that they only interact with Prosegur Corban, which makes all services available to individual third parties or networks. 'Thanks to this model, banks, public bodies or any other non-financial company can rely on a very extensive physical distribution network for their clients, administered and managed by Prosegur, which acts as a single interlocutor, both from a commercial and contractual point of view', Sieyro summarises.

‘The main difference between a robust Corban correspondent and other traditional correspondent banking services lies.’

The catalogue of services that can be carried out through Corban's retail service is, according to its director, almost infinite (cash in and cash out services, collection and payment of remittances, payment of taxes, collection of social benefits, deposits and withdrawals in bank accounts, basic home services, internet plans, catalogue purchases, leisure services...). This vast catalogue of services allows 'our more than 40,000 affiliated businesses, whether individual or part of a network, to participate through us in the sale of other people's products, in addition to generating service centres that attract new customers and retain traditional ones', adds Sieyro.

Digital account/wallet servicing is a banking digitalisation tool, ideal for unbanked, dispersed or non-resident customers, and for small and medium-sized banks, offering an advanced digital solution at no fixed cost to the bank. According to Sieyro, Corban's retail correspondent infrastructure and experience makes this service a 'robust, comprehensive and highly efficient product, in which everyone (bank and end customer) wins'.

‘In Sieyro's opinion, it is not only feasible, but it is the ideal time to do it because of the current context.’

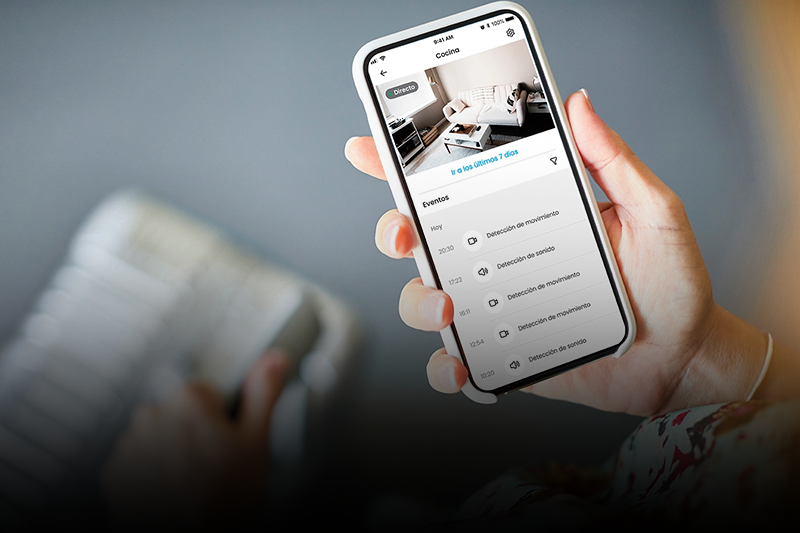

Además del soporte tecnológico y de servicio, Corban ofrece a cada entidad bancaria una app y tarjetas personalizadas, y el banco sigue gestionando los fondos de sus nuevos clientes digitales como los de cualquier otro cliente tradicional.

A model clearly exportable to Spain

A question that needs to be asked: Is it feasible to export this model to a market like the Spanish one? In Sieyro's opinion, it is not only feasible, but ‘it is the ideal time to do it because of the current context’, marked by characteristics such as the decrease in financial margins, the increase in digitalisation, the necessary adaptation of the service model and physical presence, as well as the irruption of new players in the financial sector. The legal framework has existed since 2015 (Royal Decree 84/2015 regulates the operation of financial agents) and the infrastructure and technological capabilities too, so, according to the director of Prosegur Corban, we just have to start heading towards it.

Faced with the prevailing model in Spain of financial agents managed by the bank, Corban proposes a progressive alternative model (depending on the degree of digitalisation of the customer) which, according to Sieyro, will replicate in the Spanish domestic market the advantages it has demonstrated in the countries where it is already operating: Improving business profitability for the bank, improving customer experience, complementing the digitalisation strategy, attracting new customers and business niches, transparency in management, assumption and management of risks by Prosegur Corban and guaranteeing compliance with quality standards, both those of Corban and those of the bank.

.webp)

.webp)